UK Wine Pricing Explained: Vinonomics

Following the budget announcement on 15 March 2023, the drinks and hospitality industry are preparing for the upcoming overhaul of alcohol duty – which will take effect on 1 August 2023.

According to WSTA, the forecast for RPI at 10.1% is being used as the measure for increasing duty rates on all non-draft products. Generally speaking, this reform means that the higher the alcohol per volume (ABV) of wine, the higher the new duty rate will be.

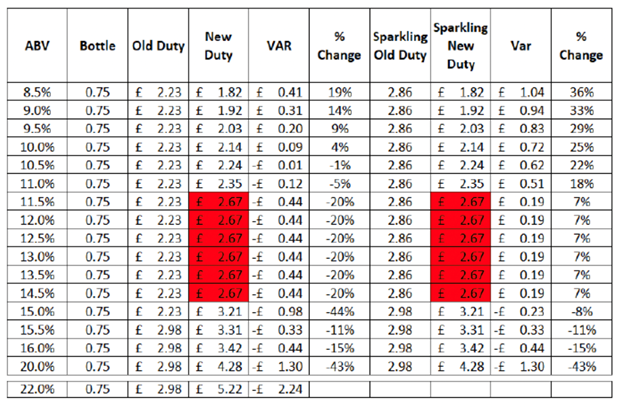

Most wine will see an increase of £0.44 per 75cl bottle or a 20% increase in the duty paid (£2.67 vs the current £2.23). This increase will be valid for wines with an ABV between 11.5% and 14.5%.

Wines with an ABV above 15% will see a duty increase of £0.97 (+44%) per 75cl bottle, and this increase gets bigger the higher the alcohol – fortified wine of +20% ABV will see a whopping £1.30 increase (duty of £4.28) per 75cl bottle.

On the upside, wine under 11.5% ABV will be treated more favourably. Duty on wine at 10% ABV, for example, will be £0.09 less than the current rate (at £2.14 per 75cl bottle).

The further abolishment of separate duty rates for sparkling and still wine means that from 1 August, a bottle of Champagne or sparkling wine will have its duty reduced by £0.19, bringing it down to £2.67 and in line with a still bottle of wine.

See the below table for a summary breakdown of the changes as of 1 August 2023 (i.e. on a 0.5% increment – duty will apply on 0.1% increments):

Note: Wine between 11.5% and 14.5% ABV will be treated as if it is 12.5% from 1 August 2023 until 1 February 2025 – the adjustment period – after which a further summary sliding scale will be implemented per 0.5% increment for wines between 11.5% and 14.5% ABV.

Now what?

Considering this elaborate overhaul, we expect some general trends to continue and emerge:

1. Premiumisation

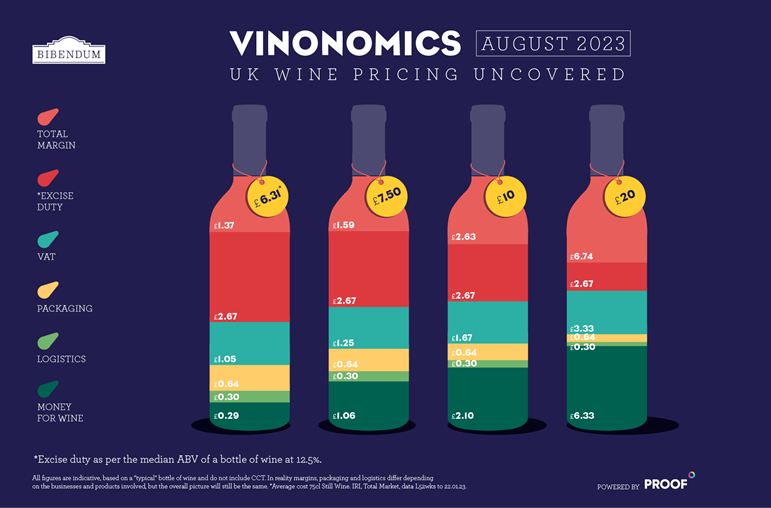

This might sound obvious enough, but considering the cost of packaging, logistics, VAT, total margins and excise duty, you will continue to get considerably more bang for your buck with premium products.

Not only do you get better quality for your money when you spend more, but this value rises at a much faster rate with bottle price. When buying a £6.31 bottle of wine – the average price of a 75cl still wine in the UK Off Trade – only 29p pays for the wine itself. By trading up to a £10 bottle, you get £2.10-worth of wine – around seven times more – while you get nearly 22 times more wine for your money (£6.33) when spending £20 on a bottle.

2. Drink in moderation

1 in 5 UK adults (20%), or 10.6 million people, are moderating their alcohol intake. While young people are more likely to engage in moderating behaviours, people of all ages are moderating to varying degrees. Main motivations include wanting to be healthier (41%), avoiding a hangover (22%) and reducing spend (27%). (Source:The Moderating Consumer Report – Proof Insight)

While switching to low and no alcohol is part of this moderating trend, we’ll continue to see more of a shift towards consumers reducing the amount of alcohol consumed during an occasion and/or switching to soft drinks and drinking less often.

3. Reduced ABV of entry level wines

We’re expecting to see a reduction in the ABVs of some entry level wines to below 11.5%, where possible. This can be achieved through vineyard practices, picking earlier, adapting winemaking techniques or dealcoholizing the final product. This trend is expected to help mitigate the increase that will be seen at ABVs over 11.5%.

4. Naturally lower ABV wines

Expanding on the above, we expect to specifically see a rise in popularity of some naturally lower ABV wines – those that are either lower by nature (like German Riesling) or by natural design (like wines made from early harvested grapes). From Vinho Verde and Muscadet, to German Riesling and Gamay, this trend might just pave the way for some often-underrated styles.

5. Rise of the mid-strength?

Considering the ascent of low alcohol drinks, we might expect to see an increase in wine sitting between 6 and 9.5% ABV, creating an entirely new category of mid-strength wines – away from the full-strength section to avoid customer confusion. Paying progressively lower rates of duty, these wines will benefit from a slightly lower cost, offering more value for money – while further tapping into the ‘moderation’ trend.

Currently, wine at 6 to 9.5% ABV represents a very small share of the market, accounting for 2.3% of still wine SKU listings in the Off Trade. While there hasn’t been any growth in terms of shelf space in the last year, this may change going forwards if supermarkets explore lower ABV options. (Source: Knowledge Gaps, 104wks to 15.05.23)

The On Trade outcome

Given the cost-of-living crisis and inflation that has already been passed on to On Trade customers this year, further price increases from the duty reform will undoubtedly have a negative impact on volumes. While the majority of venues are expected to not take any remedial action to mitigate these changes, we are expecting to see:

-

A further general decrease in On Trade wine volumes

-

Continued focus on premiumisation: drinking less but better

-

House and entry level wines with ABVs below 11.5%

-

A rise in naturally lower ABV styles of wines

-

More listings for lower ABV wine options, including alternatives such as Kombucha

-

A significant decrease in fortified wine volumes.